vermont income tax rate 2020

Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021. W-4VT Employees Withholding Allowance Certificate.

Vermont State Personal Income Tax Rates and Thresholds in 2022.

. Pay Estimated Income Tax by Voucher. 2019 Vermont State Tax Tables. Tax Year 2020 Personal Income Tax - VT Rate Schedules.

A financial advisor in Vermontcan help you understand how taxes fit into your overall financial goals. IN-111 Vermont Income Tax Return. Read the Vermont income tax tables for Single filers published inside the Form IN-111 Instructions booklet for more information.

Check the 2020 Vermont state tax rate and the rules to calculate state income tax. 2022 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. TaxTables-2020pdf 27684 KB File Format.

Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax bracket to 875 the highest Vermont. The appropriate schedule is determined by a special formula in the Vermont Unemployment Compensation Law. The tax schedules are designed so that Rate Schedule 3 provides an equilibrium.

Tax Tables 2020 2020 Vermont Tax Tables. 2020 Vermont Tax Deduction Amounts. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017.

Any income over 204000 and 248350 for SingleMarried Filing Jointly would be. 12 12 12 12. Add this amount 462 to Base Tax 2758 for Vermont Tax of 3220.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. If youre married filing taxes jointly theres a tax rate of 335 from 0 to 67450.

Pay Estimated Income Tax by Voucher. Vermonts tax rates are among the highest in the country. Vermont based on relative income and earningsVermont state income taxes are.

How to Calculate 2020 Vermont State Income Tax by Using State Income Tax Table. Base Tax is 2758. 2020 Vermont Tax Tables.

7380001 - 14885000. The states top tax rate is 875 but it only applies to single filers making more than 206950 and joint filers. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. Enter 3220 on Form IN-111 Line 8. This column also applies to qualifying widower and civil union filing jointly status This column also applies to civil union filing separately status.

2020 Vermont State Tax Tables. The Vermont Head of Household filing status tax brackets are shown in the table below. Filing Status is Married Filing Jointly.

Pay Estimated Income Tax Online. W-4VT Employees Withholding Allowance Certificate. 2020 VT Tax Tables.

Subtract 75000 from 82000. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. 15 15 15 15.

Find your pretax deductions including 401K flexible account contributions. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875. Monday February 8 2021 - 1200.

2020 Vermont Tax Rate Schedules Example. Detailed Vermont state income tax rates and brackets are available on this page. RateSched-2020pdf 11722 KB File.

Vermonts tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living. 2020 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. 8 8 8 8.

2019 VT Tax Tables. Corporate and Business Income. Find your income exemptions.

Tax Rates and Charts Mon 01112021 - 1200. In Vermont theres a tax rate of 335 on the first 0 to 40350 of income for single or married filing taxes separately. Income tax brackets are required state taxes in.

5 5 5 5. PA-1 Special Power of Attorney. Find your gross income.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. Rate Schedules 2021 Vermont Rate Schedules. Meanwhile total state and local sales taxes range from 6 to 7.

Tuesday January 25 2022 - 1200. 2020 VT Tax Tables. 0 0 0 0.

Multiply the result 7000 by 66. Vermont Tax Brackets for Tax Year 2020 As you can see your Vermont income is taxed at different rates within the given tax brackets. The Vermont Married Filing Jointly filing status tax brackets are shown in the table below.

2021 Vermont Tax Expenditure Report 6. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. 18 18 18 18.

Pay Estimated Income Tax Online. Personal Income Tax - 2019 VT Rate Schedules. There are four tax brackets that vary based on income level and filing status.

Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021. Section 1326 of the Vermont Unemployment Compensation Law provides five different rate schedules each with twenty-one tax rates. PA-1 Special Power of Attorney.

Vermont Income Tax Return. LC-142 2020 Instructions 2020 File your Landlord Certificate Form LC-142 online using myVTax or review the online filing instructions. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

VT Taxable Income is 82000 Form IN-111 Line 7. PR-141 HI-144 2020 Instructions 2020 Renter Rebate Claim. Then your VT Tax is.

Publications Department Of Taxes

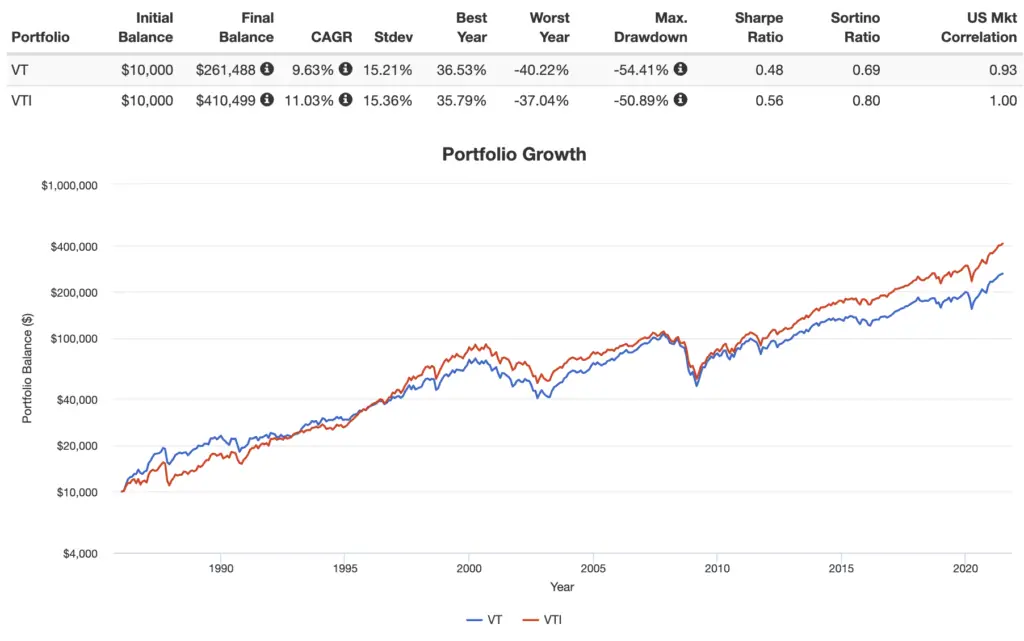

Vt Vs Vti Global Stock Market Vs Total U S Stock Market

Vermont Income Tax Calculator Smartasset

What To Know About Vermont S Property Transfer Tax Vhfa Org Vermont Housing Finance Agency

Vermont State Tax Information Support

Personal Income Tax Department Of Taxes

Vermont Ends November With Record Breaking Streak Of Severe Covid 19 Outcomes Vtdigger

Vermont Income Tax Brackets 2020

United States Population Density Kids Encyclopedia Children S Homework Help Kids Online Dictionary The Unit Map Rural Landscape

Vermont Sales Tax Small Business Guide Truic

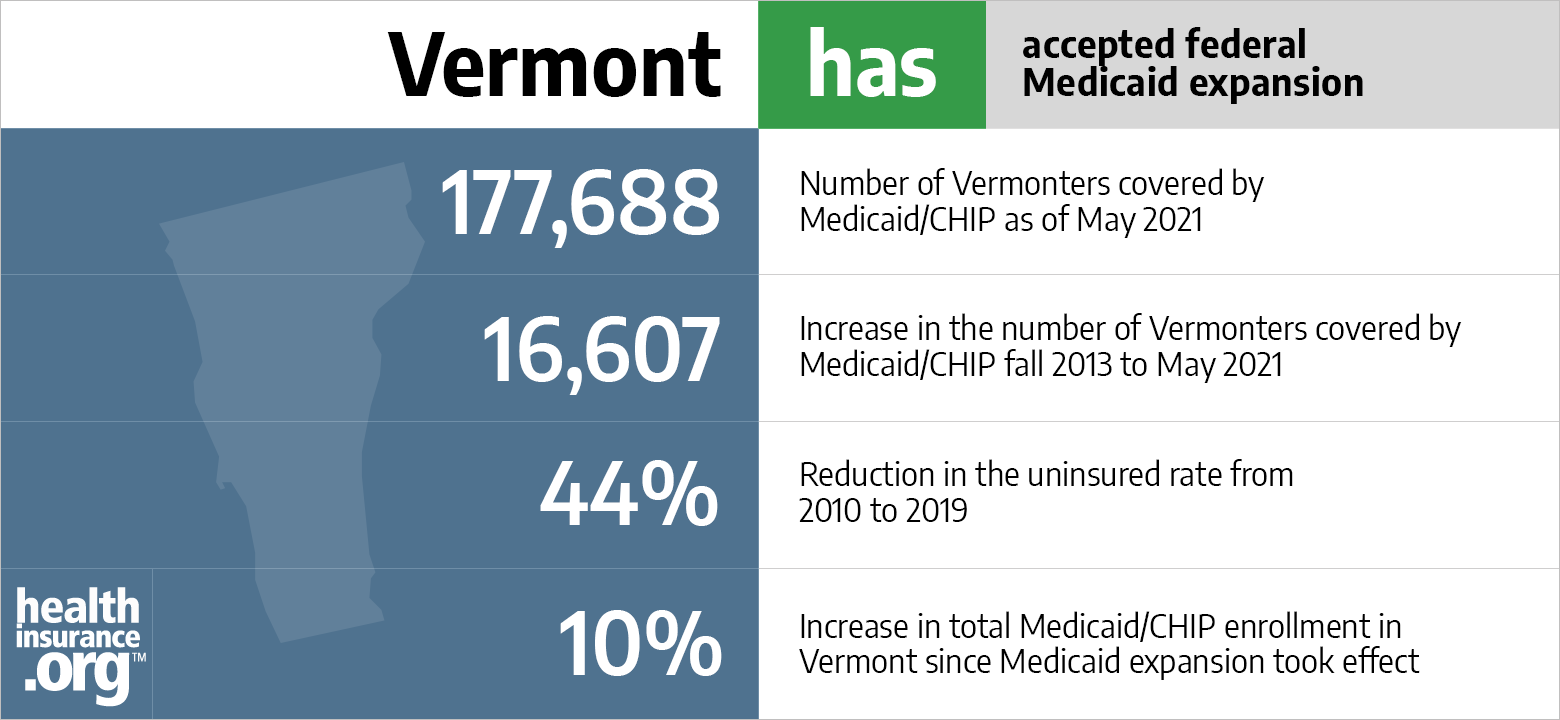

Aca Medicaid Expansion In Vermont Updated 2022 Guide Healthinsurance Org

Vermont Income Tax Calculator Smartasset

Publications Department Of Taxes

Vermont Retirement Tax Friendliness Smartasset

Personal Income Tax Department Of Taxes

Special Offers Stoweflake Mountain Resort Spa Stowe Vermont Mountain Resort Romantic Things To Do Resort Spa